As the year progresses, it appears that 2023 will be the worst year for business failures since 2009, the height of the global financial crisis. Through this challenging time, many business owners have been seeking the advice of business rescue professionals to try to save their distressed business. Yet, despite receiving definitive advice and recommendations on the best route forwards, some are then delaying for weeks and even months before taking the necessary actions at a time when their financial situation is deteriorating still further. Although it’s not an easy subject, here we look at why some business owners are delaying when their business is in distress and what the outcomes can be.

Getting a second opinion?

This is a major moment in a business’s life, so it’s entirely understandable for the owners and managers to want to be sure that they’re comfortable with the advice they have received. Indeed, they may have been running the advisory process on a competitive basis, simultaneously commissioning two or more outside experts. However, the risk here is not just the delay, but also the temptation to shop around to find the most palatable recommendations, rather than the most realistic and pragmatic options.

Getting your ducks in a row

Sometimes there are issues within the business, which need resolving before any rescue or insolvency process can be implemented to maximum effect. This is especially so where the solution involves selling all or a part of the business as a going concern. Long running disputes with key customers or suppliers could be an example. Properly documenting trading arrangements, both externally and within a group, is another. Ending toxic or uncommercial relationships or ending questionable business practices before pressing the ‘start’ button can improve the outcome.

The Ostrich syndrome

Entrepreneurs live for their businesses and are endlessly optimistic. “Surely something will turn up if we just struggle on a little longer?” While it can be hard to see how this judgment is made during such an urgent time, it is not in the nature of an entrepreneur to give in, as they may see it. Yet, this capacity for determination could be much better spent in fighting to resolve the issues within the business or winding down a business in the best circumstances possible to be able to start again anew.

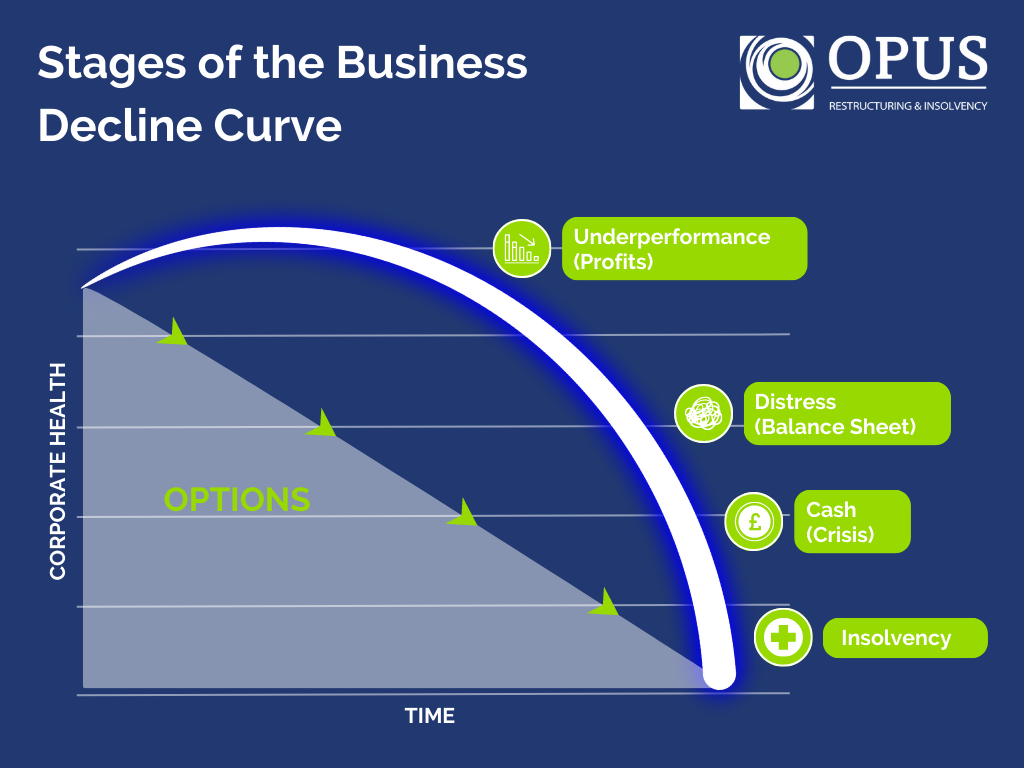

The inevitability of the Business Decline Curve

In July 2023, we examined the process of business decline in detail. The infographic below, which summarises the decline, illustrates not just the stages of deterioration, but the consequent shrinking of restorative options as time continues. This is why delaying when your business is in distress will not resolve the problem, and worse still it will materially diminish the outcome for stakeholders and the prospects of rescuing the business.

Personal downside risks

Delay doesn’t only damage the stakeholders in the business, it can create personal liabilities for Directors. If creditor losses increase, the Wrongful Trading provisions can shift liability for these extra losses onto Directors. Liabilities under Personal Guarantees can be triggered. In the worst case scenario, Directors can be subject to Disqualification proceedings initiated by the Insolvency Service.

Action this day

It’s natural for business rescue professionals to be impatient. They see the problems, have the knowledge to provide the best solutions and want to get on with helping to deliver the best possible outcome. Equally understandable is the diffidence of owners and managers about taking such momentous decisions. But tackling the issues at hand will always be the best option and doing it quickly will always produce the best result possible.

How we can help

We have extensive experience advising business owners and management teams, and we will always work with you to find the best solution for you and your business.

One of our Partners would be more than happy to have a non-obligatory confidential chat with you. We can be contacted at rescue@opusllp.com or call us on 0203 995 6380 and we will arrange for a call with one of our Partners.