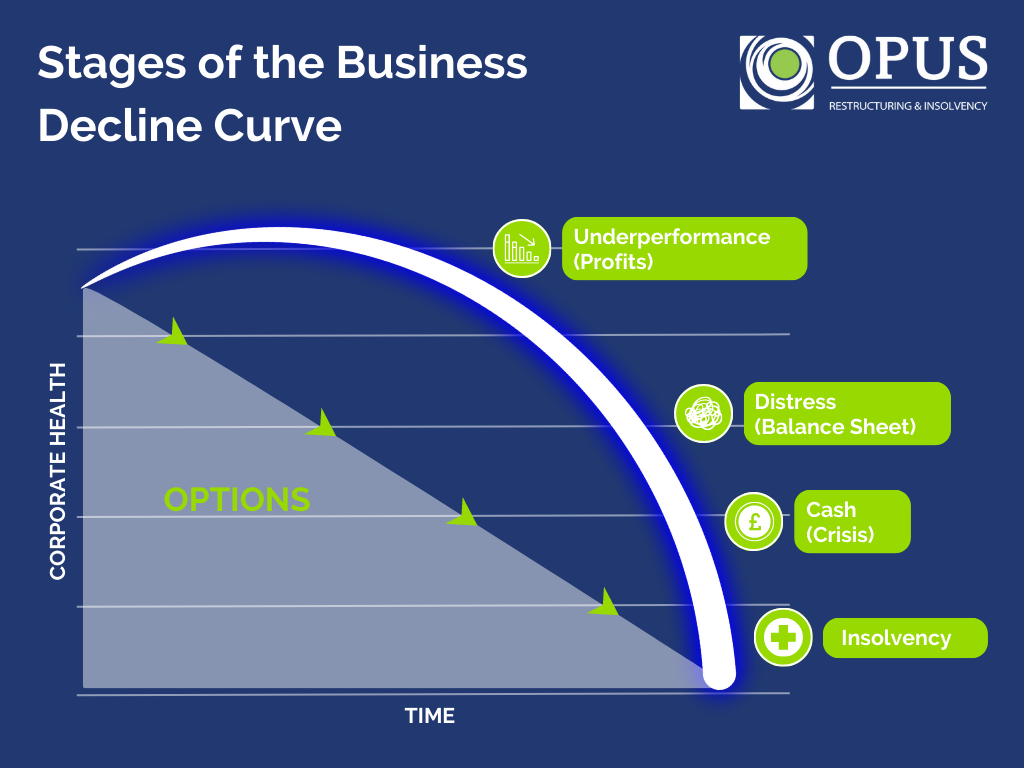

Spotting the warning signs early and taking decisive action when a business is getting into trouble is a principle preached endlessly by turnaround and business rescue professionals. There’s a very good reason for this mantra. The longer the problems go undiagnosed and the later something is done about them, the fewer constructive options there are to rectify matters and the less positive the outcome will be. This scenario is what is described in the business decline curve outlined below.

The top of the business decline curve – are sustained profits or sustainable growth possible?

Even before any problems emerge, management should constantly challenge the status quo. What needs doing to maintain the existing profit and performance levels? Are there safe opportunities to grow? Is there sufficient funding in place to support growth, or to finance existing activity levels?

Profit underperformance – why and what next?

What this looks like within a business

The budget gets missed. So what? Was it over-ambitious? How widespread was the miss? Was it just at the sales line, or also through margin shortfalls and/or overhead cost overruns? Were external factors beyond management’s control to blame? Are competitors having similar issues? Assuming the issues are more than a temporary blip, what should be done to put things right? Have management got the bandwidth and the skills to tackle the issues?

The options available

At this stage, all options are still on the table. A comprehensive business review, including the adequacy of financial resources is the start point, followed by the creation and the implementation of a comprehensive turnaround plan bought into by management and staff at all levels and with clearly assigned actions and responsibilities.

It may involve shrinking the business by turning away less profitable sales, abandoning overly-competitive markets or closing down product or service lines. It might even prompt a decision to sell the business, to merge with a competitor, or bring in new investors. These options can be hard truths for an entrepreneur and against their natural instincts, but they can be necessary. It is one of the most powerful arguments for working with experienced outside turnaround specialists who can outline all the possible options.

Balance sheet distress – repairing the damage

What this looks like

At this point, profit underperformance has been allowed to become embedded and now there are clear signs of distress in the balance sheet. The ratio of creditors to sales is escalating and creditor payment days are increasing. The use of finance facilities has hardened, rather than moving between peaks and troughs, so that overdraft and invoice discounting facilities are constantly up against their limits.

Capex has fallen away so that fixed asset values are falling, not through disposals, but because depreciation and amortisation outweighs new spending. Shareholder’s funds are falling and net worth is threatening to turn negative. Gearing is heading off the chart, either in net or gross terms. Interest costs are also rising, not just because of increased borrowings, but as lenders re-price their facilities because of the obvious balance sheet strain. Key balance sheet ratios are deteriorating.

The options

It isn’t too late to re-visit the turnaround option, or to instigate one if none has been actioned already. But now the shape of the balance sheet also needs some serious restructuring. Debt and gearing need to be returned to normal parameters, either by raising new equity to pay it down or through surplus asset sales to generate cash. Lenders need to be reassured and facilities renegotiated to reduce servicing costs, extend repayment terms or increase limits where necessary. Merger and sale options need to be looked at again, but are unlikely to be on such acceptable terms.

Just as with turnaround projects, this is an activity that requires experience, in depth knowledge of what is achievable and independent judgment. Few management teams have the necessary capacity, skills or detachment to take the really tough decisions that are involved without help and support.

Cash crisis – is there a way forward?

What this looks like

By now, cash and creditor management has taken over the lives of management, on whom suboptimal decisions are constantly being forced. Turnaround may have been tried and failed and restructuring may have only delayed matters. Paying staff is a struggle, rent is in arrears, HMRC liabilities are mounting and some of the sharper creditors are threatening enforcement action. Lenders are taking an uncomfortably keen interest. Trade insurers are pulling cover and suppliers are cutting credit terms, some even asking for cash on delivery. Customers and key staff are defecting. Market place rumours abound.

The options

Even now, there are options, but they are shrinking fast and the potential outcomes for stakeholders are diminishing. It may still be possible to find a white night trade rescuer. Administration could be the answer, ring fencing the business and assets while a solution is found or as a creditor damage limitation exercise. If the problems really are solvable and there is a viable business underneath the mounting chaos, then a Company Voluntary Arrangement (CVA) may do the trick.

Yet again, considering and choosing between these remaining options requires expert assistance, this time from insolvency practitioners.

The end game – liquidation

Occasionally a situation is simply beyond rescuing, no matter how soon the rescue attempts start. More often, management delay taking decisive action until it is so late that there is nothing left to rescue and liquidation becomes inevitable. This may either be forced on the company by a creditor through the Court as a Compulsory Winding Up, or instigated by the shareholders and the directors as Creditors Voluntary Liquidation (CVL).

The cautionary tale of the business decline curve

It’s never too soon for management to think about how their business is performing. It shouldn’t take a budget miss to prompt action. Some major multinationals are in a constant state of turnaround, a few even have specialist teams dedicated to it as an ongoing task. What is absolutely certain is that once the decline has started, the slippery slope only gets steeper, the remedial action needed more drastic and the outcomes less palatable.

How we can help

We have extensive experience advising business owners and we will always work with you to find the best solution for you and your business.

One of our Partners would be more than happy to have a non-obligatory confidential chat with you. We can be contacted at rescue@opusllp.com or call us on 0203 995 6380 and we will arrange for a call with one of our Partners.