Facing challenges as early as possible

A business’s move towards financial distress can occur quickly or advance more slowly. It may be that a primary customer ceases to trade, placing the business in an instantly challenging situation. Or, slower economic challenges may reduce a business’s cash flow over time, force greater borrowing, or lead to unpaid debts. Whatever the situation may be, our advice to company directors is always the same—seek professional advice at the earliest opportunity.

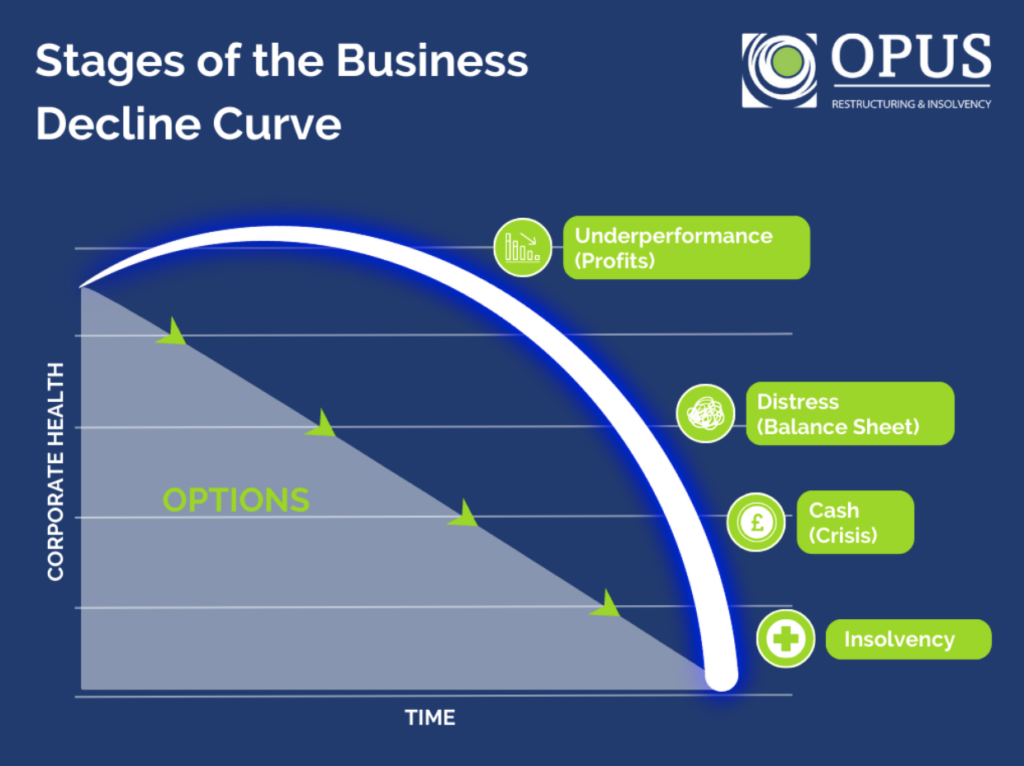

There’s good reason for this because the earlier a business spots the warning signs of financial distress and acts decisively, the more options it will have. At the earlier stages of business distress, as we have outlined on the Stages of the Business Decline Curve below, there are many more options that a business can take to return to profitability.

Stage of the Business Decline Curve

Saving a business

These measures could come in the form of a business turnaround strategy, which an Insolvency Practitioner (IP) will be well-placed to implement. There are also options for restructuring the business debt, negotiating a debt management agreement with creditors, restructuring the business’s operations to focus on profitability, or seeking funding options to continue business operations. This stage of business decline is the ideal time to approach an IP, not to wind down a business but to save it.

When does insolvency occur?

The further a business declines down the curve, the fewer options there will be available to a director to save the company. It is not that a business rescue is impossible at this stage, only more challenging. If a business enters into a cash flow crisis where it cannot pay its debts when due or finds that its balance sheet contains greater liabilities than assets, the company is already technically insolvent. These two tests are called the Balance Sheet Test and the Cash Flow Test, the details of which we have outlined in this guidance document.

Once a business has entered a technically insolvent state by meeting one of these two tests, the director’s responsibilities shift from its stakeholders to its creditors. The directors must ensure that as much of the business’s assets are now used to repay its creditors. Ignoring this and continuing to trade knowing that the business is insolvent can lead to Wrongful Trading.

Seeking the help of an Insolvency Practitioner

If your business has entered into insolvency, this is the point at which a director must take the proactive step of approaching a professional for assistance. A business rescue may still be possible at this stage, and there are also a number of formal insolvency strategies that can be implemented to retain as much of the business’s value as possible.

An IP will be able to clearly explain your options as they stand and guide you through an insolvency process if this is necessary. It can be great peace of mind for a director facing business distress to have a professional on hand who can deal with creditors on behalf of the business and manage the legalities of insolvency on the director’s behalf.

Overcoming hesitancy

Business owners have put their heart and soul into their business and are committed to seeing it succeed. Unfortunately, however, the fact is that, in the current economy, business failures are increasing. No one can be sure what is coming around the corner, leaving directors on the fence about whether they should engage an Insolvency Practitioner or carry on a little longer. While the latter may feel safe, the reality is that the further a business decline goes, the fewer options there will be available to save the business or retrieve its worth through a formal insolvency process.

Many business owners will have also given a personal guarantee as part of the funding options for their business. This binds a director’s personal assets to their business’s success or failure. This is a very serious situation when it comes to a business’s insolvency and a director will want to discuss their options and protection from personal loss as a matter of urgency.

Working with a professional firm of licensed IPs can give your business the best of both worlds. With 14 national locations around the UK, Opus LLP can provide businesses with a local, experienced Insolvency Practitioner who is part of a wider network of expertise.

How we can help

We have extensive experience assisting business owners and directors, and we will always work with you to find the best solution for you and your business.

One of our Partners would be more than happy to have a non-obligatory confidential chat with you. We can be contacted at rescue@opusllp.com or call us on 0203 995 6380 and we will arrange for a call with one of our Partners.